- The market expected a withdrawal of 13 bcf

- Natural gas continues to make lower lows

- The 1998 low loomed large

The bottom fell out of the natural gas futures market the day before the Energy Information Administration reported the inventory data in the United States for the week ending on March 13. At a low of $1.555per MMBtu, the price of the energy commodity fell to its lowest level since 1995 when it hit a low of $1.335.

Fear and panic in markets across all asset classes continue to grip markets, but health concerns trump all else in the current environment. The rising number of fatalities and cases of Coronavirus is the most significant event of our lifetime.

Meanwhile, stockpiles will go into the 2020 injection season at the highest level in years. With the economy at a halt in the United States and around the world, the demand for all forms of energy has plunged. On the other hand, the low prices and lockdowns will cause production to decline precipitously. Debt-laden energy companies will cease operations. The gluts of today could lead to shortages tomorrow. The United States Natural Gas Fund (UNG) is the ETF product that follows the price of natural gas higher and lower. UGAZ and DGAZ ETNs magnify the price moves on the up and downside. However, current market conditions increase the danger of using any leveraged products.

The market expected a withdrawal of 13 bcf

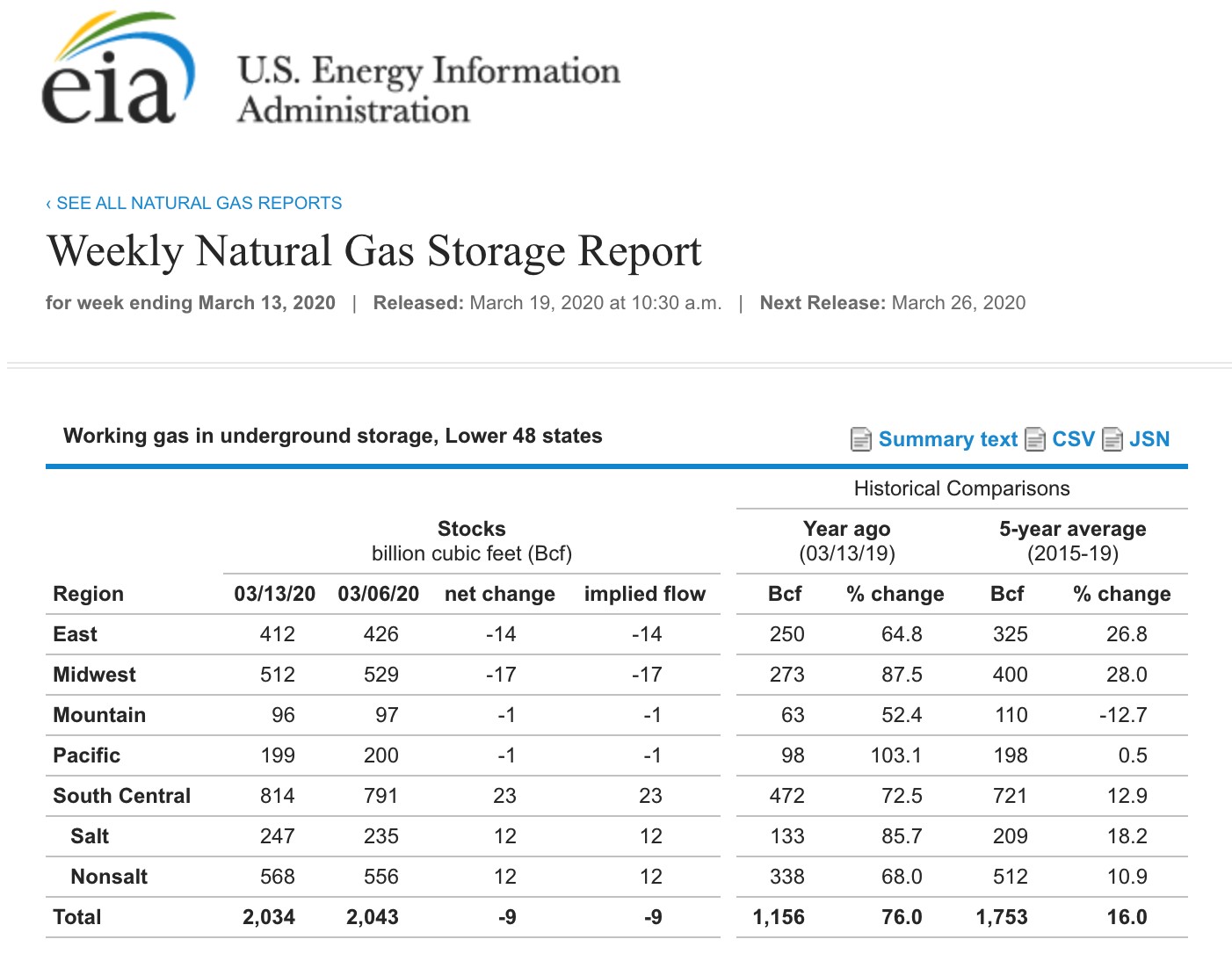

According to Estimize, the market had expected around a 13 billion cubic feet withdrawal from inventories for the week ending on March 13. The number came in a little below that level.

(Source: CQG)

The decline of only nine bcf took total sticks to the 2.034 trillion cubic feet level, which could turn out to be the low for the 2019/2020 withdrawal season. Stocks are now 76% above last year’s level and 16% over the five-year average for this time of the year. The price reaction following the was little more than a yawn. The move lower occurred the day before on March 18.

Natural gas continued to make lower lows

The natural gas market is going into the injection season with the highest level of stockpiles in years. If the data from March 13 were the final withdrawal of the peak season, there would be 927 billion cubic feet more in storage this year compared to last at the end of the winter months.

Meanwhile, the price action remains bearish in the energy commodity.

(Source: CQG)

As the daily chart highlights, lower lows continue to plague the natural gas futures market. Price momentum and relative strength indicators were pointing lower in just below neutral readings as of March 19. Daily historical volatility rose from below 26% in early February to over 64.5% on March 19.

The total number of open long and short positions declined from 1.54 million contracts in early February to 1.314 million on March 18. While the decline in the open interest metric likely reflects short-covering, last year at this time, 1.150 million contracts. Speculative shorts could be hanging around in the natural gas arena despite risk-off conditions in all other markets. On Wednesday, March 18, the price of nearby April natural gas futures fell to a low of $1.555 per MMBtu, the lowest in a quarter of a century.

The 1998 low loomed large

2020 has been a year of milestones for the natural gas futures market. In January, the price fell below the $2 level for the first time since 2016. In March, natural gas dropped to a new low for this century when the price fell to $1.61, which was equal to the lowest price since 1998. On March 18, the 1998 low and the $1.60 level gave way on the downside.

(Source: CQG)

The quarterly chart highlights that the low on March 18 at $1.555 was the lowest price since 1995 when natural gas bottomed at $1.335, the next level of technical support.

Now that the peak withdrawal season is winding down, natural gas typically falls to a seasonal low. Meanwhile, the risk-off conditions in markets across all asset classes and speculative short positions on natural gas could lead to another round of short-covering. However, demand destruction on the back of the spread of Coronavirus and value evaporation in all markets is far from bullish for the price of the energy commodity that can be the most volatile.

The EIA report on March 19 was not bullish for the price of the energy commodity and could have been the final withdrawal of the peak season.

The United States Natural Gas Fund L.P. (UNG) was trading at $12.99 per share on Thursday afternoon, up $0.25 (+1.96%). Year-to-date, UNG has declined -44.30%, versus a -7.98% rise in the benchmark S&P 500 index during the same period.

UNG currently has an ETF Daily News SMART Grade of C (Neutral), and is ranked #51 of 109 ETFs in the Commodity ETFs category.

About the Author: Andrew Hecht

Andrew Hecht is a sought-after commodity and futures trader, an options expert and analyst. He is a top ranked author on Seeking Alpha in various categories. Andy spent nearly 35 years on Wall Street, including two decades on the trading desk of Phillip Brothers, which became Salomon Brothers and ultimately part of Citigroup. Over the past decades, he has researched, structured and executed some of the largest trades ever made, involving massive quantities of precious metals and bulk commodities. Aside from contributing to a variety of sites, Andy is the Editor-in-Chief at Option Hotline.

Andrew Hecht is a sought-after commodity and futures trader, an options expert and analyst. He is a top ranked author on Seeking Alpha in various categories. Andy spent nearly 35 years on Wall Street, including two decades on the trading desk of Phillip Brothers, which became Salomon Brothers and ultimately part of Citigroup. Over the past decades, he has researched, structured and executed some of the largest trades ever made, involving massive quantities of precious metals and bulk commodities. Aside from contributing to a variety of sites, Andy is the Editor-in-Chief at Option Hotline.