Iron ore prices have cooled-off slightly with prices of iron ore futures on the Dalian Commodity Exchange in China falling from its recent high of RMB 692.00 (intraday high on 18 March 2020) to reach a low of RMB 644.00 (intraday low on 24 March 2020), marking a fall of ~ 6.93 per cent.

After reaching RMB 644.0, the commodity has shown a sideways movement with price recovering to RMB 669.0 on 26 March 2020, and thereafter, hovering near the same. The commodity is correspondingly responding to the balanced demand and supply equation, which is keeping both a considerable up and down in check.

Also Read: Iron ore Prices Beating Market Headwinds as Supply Chain Gets Derailed Thanks to Virus

The Demand and Supply

The iron ore port stock across China is on a decline for the second consecutive week, with the stocks across the 35 significant Chinese ports falling by 0.91 million metric tonnes to stand at 106.86 million metric tonnes (as on 3 April 2020), which also remained 30.44 million metric tonnes down against the previous corresponding period.

The decline in port stocks across China was mainly led by the lack of shipment from Australia and Brazil, which is due to stringent measures in place that are creating a bottleneck for the iron ore supply inbound to China. In Australia, the Federal and various State governments had issued measures to keep a lid on the COVID-19 spread, including a travel ban and ban on non-essential services, leading to a temporary suspension in mining activities across the continent.

In the recent past, major iron ore miners such as Rio Tinto Limited (ASX:RIO), BHP Group Limited (ASX:BHP) and Fortescue Metals Limited (ASX:FMG) put a temporary brake on some of their operations, which is majorly contributing towards the iron ore supply shortage.

To Know More, Do Read: Base Metals Out of Woods Poised for an Overnight Spike or Risk of Another Sell-off Remains?

While the Australian supply side is derailed by the response of the Federal and various State governments, the Brazilian counterpart- Vale, which is one of the largest Brazilian iron ore exporters to China, is facing some headwinds from the directive of Brazil’s National Mining Agency, which has called for a halt in operations across 47 mining sites, which includes approx. 25 sites of the behemoth-Vale.

To Know More, Do Read: ANM to Halt Operations at 47 Brazilian Mining Sites; 25 Vale Dams Included

While the iron ore supply side is supporting the commodity, demand, on the other hand, is oblique in the status quo. Daily average deliveries from the 35 significant Chinese ports stood at 2.73 million metric tonnes (for the week ended 3 April 2020), down by 24,000 metric tonnes against the previous week; however, many industry experts anticipate that steel mills will restock in smaller quantities but at greater frequencies ahead of the three-days Tomb Sweeping Day holiday.

Falling Steel Inventory Across China- An Early Signal of Upcoming Demand?

The inventory of steel rebar or construction steel across social warehouses and steel mills fell for the third consecutive week (as on 2 April 2020), as the downstream demand picked up steam; however, the market estimates that despite the decline, steel rebar inventories extended slightly as of 2 April, which coupled with the higher industry projected arrivals of foreign steel billet in China, could exert the pressure on steel rebar prices ahead, further keeping a lid on iron ore demand.

For now, many of the local analysts in China estimate, that the demand from downstream consumers has resumed to over 60 per cent, which is now leading towards a decline in rebar inventory across steel mills and social warehouses in China.

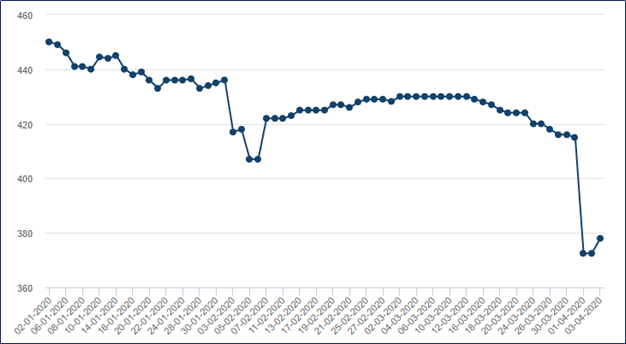

The steel rebar prices have just recovered slightly with the near-month contract of steel rebar futures, increasing from USD 372.5 (as on 1 April 2020) to the level of USD 378 (as on 3 April 2020) per tonne, after a steep fall from the level of USD 450.0 per tonne seen at the beginning of the year 2020.

Near Month Steel Rebar Futures (Source: LME)

The decline in steel rebar inventory coupled with a slight recovery in prices and a decline in iron ore supply could provide a cushion to iron ore prices over the short run.

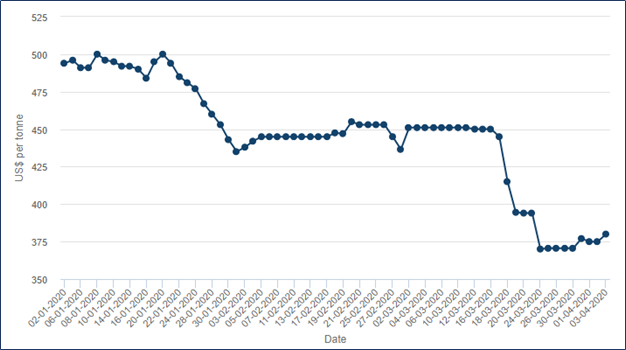

Just like steel rebar, the demand for hot-coiled steel (or HRC) is also picking up slightly across China, leading to a decline in social and steel mills HRC inventories. The HRC inventory across social warehouses and steel mills in China plunged by 2.2 per cent for the week ended 2 April 2020 to stand at 5.45 million metric tonnes, which marked a third consecutive fall in the inventory.

Near Month HRC Futures (Source: LME)

The decline in inventory is extending its support to the price of the commodity with prices of near-month HRC steel futures on the London Metal Exchange recovering slightly from a low of USD 370.5 (as on 30 March 2020) to the level of USD 380.0 (as on 3 April 2020).

In a nutshell, the iron ore port inventory is under pressure across China amid a decline in shipment from Australia and China, and the demand is slightly picking up, which could give iron ore price a short boost; however, the market anticipates that the steel demand in its price could remain in slight pressure over the COVID-19 outbreak, which is a potential risk to the iron ore demand.

However, recent manufacturing and non-manufacturing data from China suggests that the red dragons are under a recovery mode, with its March Manufacturing PMI extending above the threshold of 50.0 to stand at 52.0, showing an expansion, and Non-Manufacturing PMI extending to 52.3.

The Caixin Manufacturing PMI also crossed the threshold above 50.10 for March 2020 to stand at 50.1. All the manufacturing and non-manufacturing PMIs remained above the industry anticipation, which in turn, could boost the market confidence in China ahead as well.