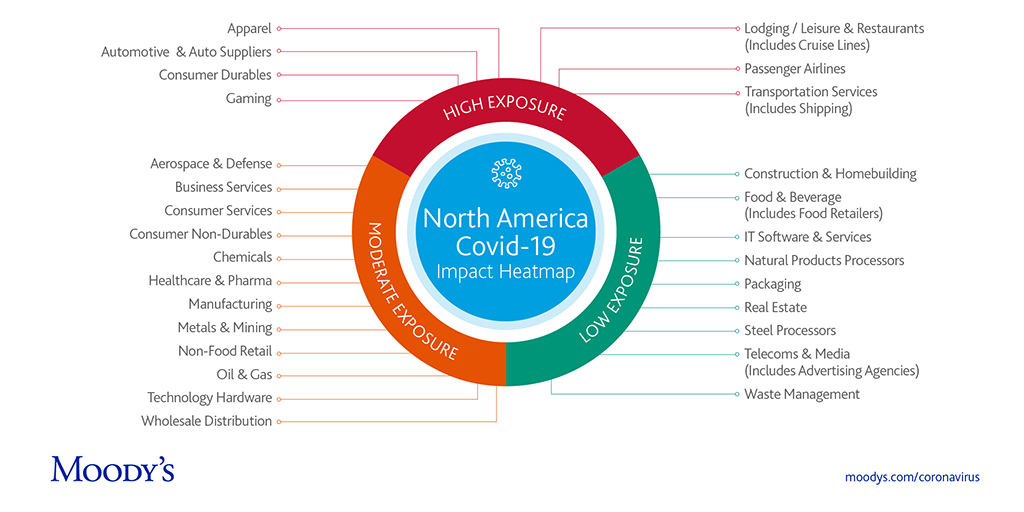

When Moody’s released its Global Coronavirus Heat Map, apparel was red hot.

The apparel industry, according to the ratings agency, is highly exposed to business shocks from the global coronavirus response along with the automotive industry, travel, passenger airlines, hotels and restaurants among others.

“What started as a supply shock, is now obviously a demand shock,” John Thorbeck, chairman of Chainge Capital and former general manager of Nike told Supply Chain Dive.

Moody’s Investor Service

Businesses that depend on consumer discretionary spending — those deemed ‘non-essential’ business activity — are facing an indefinite period of low activity. Retailers are looking at weeks (and possibly months) of not just store closure and movement restrictions, but also depressed consumer demand.

There’s a broader conversation on the horizon about the prevailing business model in the apparel industry and whether it is due for an overhaul. But in the near-term, what can operations teams do to shore up their defenses? With such an unprecedented set of restrictions and uncertainties, universal recommendations are hard to come by, but some trends are starting to surface.

First step: reduce incoming inventory

The top line, most immediate action apparel and accessory supply chains are taking is to reduce planned and scheduled incoming inventory — especially for brands with less basic, more seasonal and trend-driven fashion.

Tailored Brands CFO Jack Calandra said Wednesday the company would eliminate all discretionary spending including reducing planned inventory purchases, with a plan for more cuts if stores are closed beyond March 28.

“We believe the aggressive actions we’ve taken and the contingency plans we’ve developed will allow us to weather this period of uncertainty,” the CFO said on a Wednesday earnings call.

Guess executives similarly said inventory control was their first reaction to the shutdown of many of its stores worldwide, on a Wednesday earnings call.

Guess, like so many apparel businesses in recent years, has been working to “right-size” its inventory for several quarters. Inventory was down 16% year-over-year at the end of the fourth quarter, which CFO Katie Anderson described as a “clean position” meaning the apparel in stock was current and the retailer would not need to heavily discount it or sell inventory into off-price channels.

“We’re strategically reducing our inventory commitments considering the demand deceleration. This is clearly a dynamic process, and it will require daily monitoring and active communication with our teams and vendor partners,” Guess CEO Carlos Alberini said on the call.

Getting a handle on what’s incoming and when is key, if possible. After the manufacturing delays in China, some brands are now somewhat surprised when pallets of goods show up at their warehouses, Ronen Lazar, CEO of Inturn, an off-price channel and inventory management software company, told Supply Chain Dive. Some brands are even taking the drastic measure of refusing shipments that show up at their facilities, Lazar said. Though there may be consequences depending on supplier contract terms, some are taking the risk rather than taking possession of inventory they may not be able to sell.

Think about timing (but spare a thought for suppliers)

Is spring canceled? Is summer? These questions haunt operation and buying teams. These questions haunt operation and buying teams for highly seasonal apparel brands. The answers though cannot be painted with such a broad brush.

Early spring merchandise likely landed before Lunar New Year, according to Jon Gold, vice president for supply chain and customs policy at the National Retail Federation. Late spring and early summer merchandise, along with planned replenishments, has likely just arrived, is on the water or about to arrive. And late summer and back-to-school merchandise is in production now.

“Even if things get back to normal quickly, this is going to take a lot longer to unrave.”

Since many apparel companies experienced shipment delays when Chinese factories did not recover for weeks due to COVID-19 concerns, spring was somewhat delayed already.

“Effectively spring-summer is pushed to fall,” Lazar said. Anything in stock now that can be sold in fall, will be.

For Guess, it means pushing other seasons back. “We have opportunities now to really move the development cycle,” Alberini said. “So something that we were going to develop in the month of June may now be developed a few weeks later.”

Retailers and wholesalers can’t shift orders back neatly like a meeting on a digital calendar. Product development and delivery schedules are complex, as is the warehouse space to accommodate them. “Even if things get back to normal quickly, this is going to take a lot longer to unravel,” Lazar said.

Optimize e-commerce but don’t count on it

Simplicity, though out of fashion among the global apparel powerhouses, may offer salvation for some. Land’s End, for example, had its Spring and summer product en route when executives spoke to investors on an earnings call on March 17. A simple retail footprint (only 5% from stores) and simpler operations (the company uses one central warehouse for all types of fulfillment) leave fewer open questions.

Hence, the company expressed confidence it would not be in the situation many retailers will likely face — one of quickly aging inventory sitting in stores, inaccessible to the brands’ e-commerce operations.

With inevitable order changes already in process or coming soon, Kearney Partner Balika Sonthalia advised apparel companies not to neglect suppliers, who will also take a hit from the global pandemic. She recommends retailers and wholesalers dynamically adjust forecasts while sharing changes with manufacturers at every step.

“In current times, it is critical to keep good relations with the apparel manufacturers who are receiving the short end of the stick and when every other retailer/distributor is canceling orders or not taking control of inventory,” she wrote in an email to Supply Chain Dive.

Without open stores or customers in the streets to fill them, e-commerce might seem like a natural diversion for demand. Brands are taking varied approaches that run the gambit from heavily promoting e-commerce and lowering or eliminating free shipping minimums, to closing e-commerce operations for the health and safety of warehouse employees.

“Excess inventory that is seasonal will likely get obsolete or go into clearance sales. Instead of bearing the cash risk and incurring all the carrying costs retailers could look at using that excess inventory to help the cause.”

Balika Sonthalia

Partner, Kearney

Designer Brands, which runs DSW, is counting on e-commerce during this period of closed stores.

“The investments we have made over the last four, five, six, seven years to develop the omnichannel capabilities, those things are going to pay back in a huge way right now, because while we are shutting the stores down to the consumer walking in day in and day out shopping, we are going to keep them up and operating as fulfillment centers, so leveraging them as a huge asset, because we are within 20 minutes to 70% of the U.S. population,” CEO Roger Rawlins said March 17.

As long as government mandates don’t ban non-essential business operations as they have in New York and California, DSW’s store-based e-commerce fulfillment model may help it maintain operations and rid stores of some otherwise immovable inventory.

Gaining access to store inventory and directing it toward e-commerce is one solution to the problem of trapped inventory in stores, but e-commerce may not come to the rescue, early data suggests. Pure-play e-commerce revenue was down 63% on March 18 compared to a pre-virus benchmark, according to digital advertising performance tracking service Within.

Planning for excess inventory long term

Every company has a different set of challenges in the current situation based on existing inventory levels, store and warehouse geography, financial health, existing technological tools, supply chain visibility … the list goes on. One of the few universal recommendations, though, is retailers need to plan with the assumption that stores may be closed for longer than the two week-period originally stated by both the White House and many state and local governments.

“This changes every day, so I think we know retailers need to plan for the worst,” Gold said.

A thoughtful plan with long-term benefits in mind is the order of the day.

“Excess inventory that is seasonal will likely get obsolete or go into clearance sales. Instead of bearing the cash risk and incurring all the carrying costs retailers could look at using that excess inventory to help the cause,” Sonthalia told Supply Chain Dive.

The COVID-19 pandemic has created many needs for apparel and fabric, whether in the form of masks for healthcare workers or donations for families with interrupted income. Fashion designers and brands like Christian Siriano, Prada, Gucci, Balenciaga, H&M and Zara have pledged to redirect production efforts to make masks and other needed personal protective equipment. Doing the same with unsold clothes could add to the benefit down the road, said Sonthalia, noting that she hasn’t seen this idea put into action yet.

“These moves will build the brand significantly and when we are past the crises these companies will cash in on these measures for many years to come,” she said.

This story was first published in our weekly newsletter, Supply Chain Dive: Operations. Sign up here.